In the logistics industry, bad debts can significantly undermine financial stability and operational efficiency. The article ‘Preventive Measures for Avoiding Bad Debts in Logistic Operations’ delves into strategies for mitigating the risks associated with non-payment and financial delinquency. It explores a comprehensive approach, from understanding the root causes of bad debts to implementing robust credit management policies, leveraging technology, enhancing client relationships, and adhering to legal standards. This proactive stance is crucial for maintaining a healthy cash flow and ensuring the longevity of logistics businesses.

Key Takeaways

- Recognizing the common causes and assessing credit risk are fundamental steps in preventing bad debts in logistics.

- Clear credit terms and regular credit reviews are essential components of an effective credit management policy.

- Technological advancements such as automated credit scoring and real-time monitoring can significantly reduce the risk of bad debts.

- Strengthening client relationships and maintaining open communication channels are proactive measures that can help in early detection and resolution of payment issues.

- Compliance with legal and regulatory frameworks is critical to protect logistics operations from financial and reputational harm.

Understanding the Risks of Bad Debts in Logistics

Identifying Common Causes of Bad Debts

In our experience, supply chain debts are a growing concern, often leading to operational disruptions and financial strain. The root causes are multifaceted, but we can pinpoint a few recurring culprits.

- Late payments from clients

- Disputes over service quality or delivery

- Inaccurate billing or administrative errors

- Economic downturns affecting client solvency

We’ve learned that communication is key. Establishing clear payment terms and maintaining open lines with clients can mitigate many of these issues. It’s not just about demanding payment; it’s about understanding the situation and working together to find a solution.

Best practices in the logistics industry underscore the importance of proactive engagement and transparent policies to prevent bad debts.

Assessing Credit Risk in Logistics Clients

We prioritize a thorough evaluation of our clients’ creditworthiness. Assessing credit risk is not just about protecting our assets; it’s about fostering sustainable business growth. We focus on key indicators:

- Payment history

- Financial health

- Industry reputation

Credit scoring models are our go-to tools, providing a quantitative measure of risk. But numbers only tell part of the story. We also consider qualitative factors, such as market conditions and client relationships.

Our goal is to strike a balance between risk and opportunity, ensuring that we extend credit to clients who are both reliable and profitable.

By maintaining a dynamic approach to credit assessment, we adapt to changing economic landscapes, safeguarding our operations against potential bad debts.

The Impact of Bad Debts on Logistics Operations

Bad debts are a silent storm in logistics, eroding our bottom line. They strain our cash flows, forcing us to navigate financial turbulence. We witness a domino effect: delayed payments lead to compromised purchasing power, and in turn, hinder our ability to invest in growth.

Cash flow is the lifeblood of our operations. When it’s blocked, our capacity to maintain service levels drops, affecting customer satisfaction. We must recognize the real costs of bad debts, not just in dollars but in lost opportunities and damaged reputations.

- Increased operational costs: Recovering debts means more resources spent on administration.

- Reduced investment: Funds tied up in unpaid invoices limit our ability to expand.

- Customer trust: Persistent debt issues can tarnish our reliability in the eyes of clients.

We’re in this together. A single unpaid invoice can ripple through our financial ecosystem, impacting all facets of our operations. It’s imperative we safeguard against bad debts to ensure our logistical network remains robust and resilient.

Implementing Effective Credit Management Policies

Setting Clear Credit Terms and Conditions

We must establish unambiguous credit terms and conditions from the outset. This clarity is the cornerstone of a healthy financial relationship. Our terms should cover payment deadlines, interest on late payments, and consequences of non-compliance.

Transparency is key. Both parties need to understand the expectations and obligations involved. Here’s a simple checklist to ensure nothing is overlooked:

- Define precise payment terms (e.g., net 30, net 60)

- Specify acceptable payment methods

- Outline late payment penalties

- Detail the process for handling disputes

By setting these parameters, we safeguard our operations against misunderstandings that can lead to bad debts.

Remember, a well-drafted agreement is a protective shield for our logistics operations. It’s not just about having terms in place; it’s about making them clear, enforceable, and known to all relevant parties.

Conducting Regular Credit Reviews

We understand the importance of vigilance in maintaining a healthy financial ecosystem within our logistics operations. Regular credit reviews are a cornerstone of this approach, ensuring we stay ahead of potential non-payment risks.

Credit reviews are not a one-time affair; they’re an ongoing process. We prioritize due diligence and risk management, integrating proactive measures such as credit checks, negotiation, and arbitration to safeguard our interests.

- Review credit reports annually

- Update credit policies based on current data

- Monitor clients’ financial health regularly

By staying informed and responsive, we minimize the chances of bad debts sneaking up on us.

Our commitment to regular credit reviews reflects our dedication to operational excellence and financial stability.

Utilizing Credit Insurance

We can’t predict the future, but we can safeguard our finances. Credit insurance acts as a buffer against unforeseen defaults. It’s not just about risk mitigation; it’s about peace of mind. With the right policy, we transform the uncertainty of client solvency into a calculated business expense.

- Evaluate potential insurers carefully

- Choose a policy that matches our risk profile

- Ensure coverage is adequate for our needs

By transferring the risk of non-payment to an insurer, we focus on what we do best: delivering exceptional logistic services.

Credit insurance also offers us a competitive edge. Clients trust us more when they know we’re covered. It’s a strategic move that speaks volumes about our commitment to stability and reliability. Remember, it’s not just about protecting our assets; it’s about building a resilient business model that can weather financial storms.

Leveraging Technology for Debt Prevention

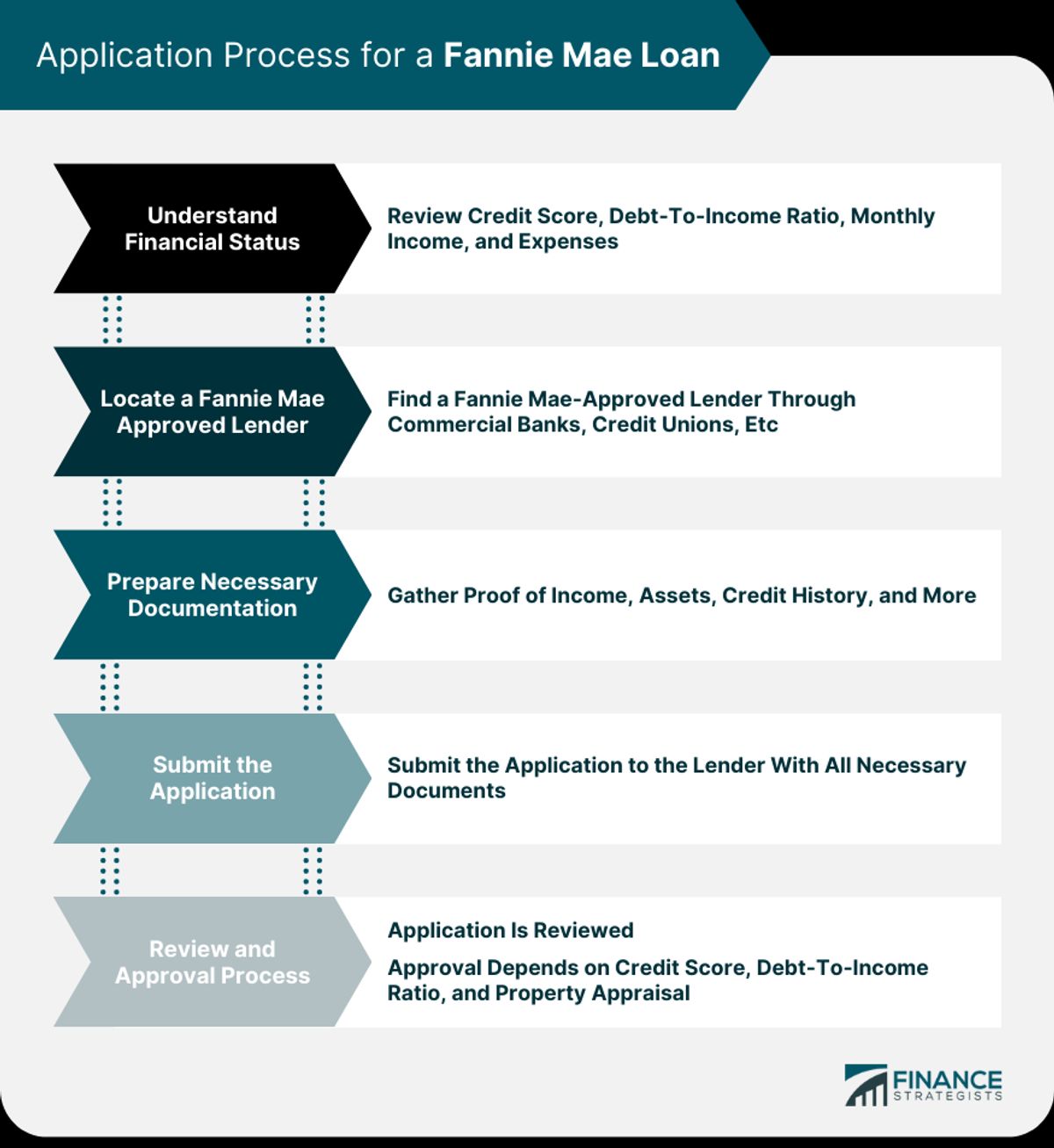

Automated Credit Scoring Systems

In our quest to mitigate bad debts, we’ve embraced automated credit scoring systems. These powerful tools harness vast amounts of financial data to assess the creditworthiness of clients swiftly and accurately. We prioritize effective data management for debt recovery, ensuring that our decisions are informed by the most relevant and up-to-date information.

- Credit scoring based on financial data allows for a nuanced understanding of a client’s fiscal health.

- Regular performance monitoring is crucial; it directly improves debt recovery outcomes.

- We’re constantly analyzing trends, including the burgeoning impact of e-commerce on credit risk.

By integrating these systems into our operations, we’ve seen a marked improvement in our ability to predict and prevent bad debts.

Our commitment to innovation in credit management is unwavering. We continue to refine our approaches, always with an eye towards the future of logistics and financial stability.

Real-Time Financial Monitoring Tools

In the fast-paced world of logistics, we stay ahead with real-time financial monitoring tools. These powerful platforms offer instant insights into the financial health of our operations and clients. They enable us to make informed decisions swiftly, mitigating the risk of bad debts.

- Instantly track outstanding invoices

- Monitor client payment behaviors

- Receive alerts for late payments

By keeping a vigilant eye on cash flows, we ensure liquidity and financial stability. These tools are not just about oversight; they’re about empowering proactive financial management.

The benefits are clear: reduced administrative burden, enhanced visibility, and the ability to anticipate issues before they become problematic. With these tools, we’re not just reacting; we’re strategically maneuvering to secure our financial future.

Electronic Invoicing and Payment Solutions

We’ve turned the corner with electronic invoicing and payment solutions, streamlining our billing processes like never before. Go paperless, go green, and most importantly, go efficient. These systems not only reduce the risk of human error but also ensure faster payment cycles.

- Immediate invoice delivery

- Automated payment reminders

- Easy tracking of invoice status

By integrating these solutions, we’re not just simplifying operations; we’re fortifying our financial defenses.

We also leverage data analytics to gain predictive insights, which are crucial for debt recovery optimization and maintaining a healthy cash flow. It’s about being proactive, not reactive. Embrace digital invoicing for efficiency and faster payments.

Strengthening Client Relationships and Communication

Proactive Client Engagement Strategies

We understand the importance of a proactive debt recovery process. By contacting clients professionally, we maintain the delicate balance between firmness and courtesy. Tracking outstanding balances diligently ensures we’re always on top of our financials, while strategic negotiation of payment terms keeps our cash flow healthy.

We prioritize operational stability in the transportation and logistics sector.

To achieve this, we’ve established a clear set of steps:

- Engage with clients early to set expectations

- Monitor account activities consistently

- Address issues as they arise, not after they’ve escalated

Our approach is not just about recovery; it’s about building a foundation of trust and reliability with our clients.

Transparent Dispute Resolution Processes

We embrace mediation and dispute resolution as cost-effective solutions for managing unpaid bills. By focusing on common ground and mutual benefits, we aim to resolve conflicts amicably and maintain healthy business relationships.

Clear communication is the cornerstone of our dispute resolution process. We ensure that all parties understand the terms and the steps involved in resolving any discrepancies.

Our goal is to prevent disputes from escalating, thereby protecting our operations from the financial burdens that come with protracted disagreements.

- Establish the facts and figures involved

- Engage in open dialogue with the client

- Propose fair and equitable solutions

- Document the agreed-upon resolution

Credit risk assessment is a continuous process in our logistics operations, crucial for preventing financial burdens and safeguarding our business interests.

Regular Financial Health Check-Ups with Clients

We prioritize proactive debt recovery by scheduling consistent follow-ups. These aren’t just courtesy calls; they’re strategic touchpoints to ensure our clients are on solid financial footing. Regular check-ups are crucial for spotting potential issues early on.

- Initiate open dialogues about financial positions

- Review payment histories and patterns

- Discuss upcoming projects and their financial implications

By maintaining an ongoing conversation, we’re not just chasing payments—we’re building partnerships.

Our digital tools streamline these interactions, making them more efficient and less intrusive. This approach not only fosters trust but also promotes timely settlements, which is vital for our financial stability.

Legal and Regulatory Considerations

Understanding International Trade Laws

In our globalized economy, logistics operations often span multiple countries, each with its own legal framework. We must navigate these complex waters with precision to avoid the pitfalls of bad debts. Familiarity with international trade laws is not just beneficial; it’s a necessity for safeguarding our financial health.

Cross-border transportation challenges are a reality we face daily. From customs clearance delays to currency exchange fluctuations, and legal implications, our proactive measures and transparency are essential. We prioritize these to mitigate risks and maintain client trust.

By staying abreast of the latest legal developments and adapting quickly, we ensure compliance and minimize the risk of financial setbacks.

Understanding the nuances of international trade agreements, tariffs, and taxes can be the difference between a profitable operation and a costly oversight. We’re committed to continuous learning and adaptation in this ever-evolving landscape.

Compliance with Financial Reporting Standards

We must align with the ever-evolving financial reporting standards. Ensuring compliance is not just a legal mandate; it’s a strategic move to maintain transparency and trust with our clients and stakeholders.

- Regular updates to our accounting practices

- Adherence to international and local standards

- Continuous staff training on new regulations

By staying compliant, we safeguard our operations against legal repercussions and reinforce our commitment to ethical business practices.

Navigating Bankruptcy and Insolvency Proceedings

When clients face bankruptcy or insolvency, we must tread carefully. Our priority is to minimize losses while respecting legal boundaries. It’s essential to understand the nuances of bankruptcy laws that vary by country and industry.

- Review the client’s financial status and history.

- Consult with legal experts to understand your rights.

- Act promptly to file claims and secure assets.

We navigate these complex proceedings with a clear strategy, aiming to recover what we can without compromising our integrity or relationships.

Remember, prevention is better than cure. By staying informed and prepared, we can better handle these challenging situations.

Navigating the complex landscape of legal and regulatory considerations in debt collection can be daunting. At Debt Collectors International, we understand the intricacies involved and are committed to providing you with the expertise needed to ensure compliance and maximize recovery. Our seasoned professionals are equipped to handle every aspect of the collection process, from skip tracing to judgment enforcement. Don’t let legal uncertainties hinder your collection efforts. Visit our website to learn more about our services and how we can assist you in turning receivables into revenue.

Frequently Asked Questions

What are common causes of bad debts in logistics?

Common causes include clients’ financial instability, inadequate credit checks, economic downturns, industry-specific risks, and invoicing errors.

How can credit risk be assessed in logistics clients?

Credit risk can be assessed by analyzing financial statements, credit scores, payment histories, and industry reputation, as well as considering economic conditions.

What impact do bad debts have on logistics operations?

Bad debts can lead to cash flow problems, reduced profitability, strained resources, and potential damage to business relationships and credit ratings.

Why is setting clear credit terms important in logistics?

Clear credit terms ensure both parties understand payment obligations, reduce misunderstandings, and provide a basis for legal action if necessary.

How can technology help prevent bad debts in logistics?

Technology can help through automated credit scoring, real-time financial monitoring, and electronic invoicing/payment solutions to enhance accuracy and efficiency.

What legal considerations should be taken into account to avoid bad debts?

It’s important to understand international trade laws, ensure compliance with financial reporting standards, and be prepared for navigating bankruptcy and insolvency proceedings.