Cross-border logistics debts can be a major headache for businesses involved in international trade. These debts can have a significant impact on the financial health of companies and pose numerous challenges in their management. In addition, there are several legal considerations that need to be taken into account when dealing with cross-border logistics debts. However, there are strategies that businesses can adopt to minimize these debts and ensure effective debt recovery. In this article, we will explore the understanding of cross-border logistics debts and discuss effective debt recovery practices in this context.

Key Takeaways

- Cross-border logistics debts can have a significant impact on the financial health of businesses involved in international trade.

- Managing cross-border logistics debts can be challenging due to various factors such as currency conversions, language barriers, and different legal systems.

- Businesses need to consider the legal implications of cross-border logistics debts and ensure compliance with international trade laws.

- Strategies such as proper documentation, proactive communication, and risk assessment can help minimize cross-border logistics debts.

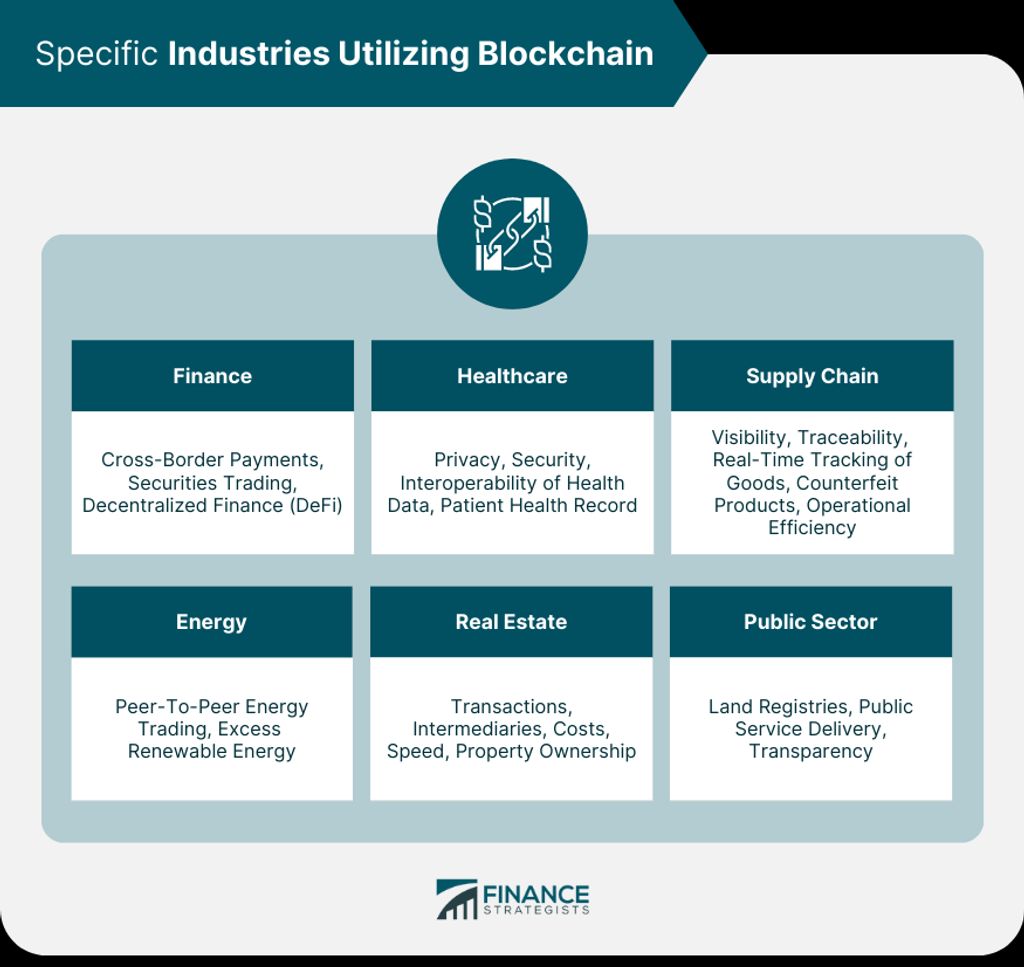

- Technology plays a crucial role in debt recovery in cross-border logistics, enabling efficient tracking, communication, and payment processes.

Understanding Cross-Border Logistics Debts

The Impact of Cross-Border Logistics Debts on Businesses

Cross-border logistics debts can have a significant impact on businesses. DCI is one such debt that can cause financial strain and disrupt operations. It is crucial for businesses to understand the implications of cross-border logistics debts and take proactive measures to manage them effectively.

Challenges Faced in Managing Cross-Border Logistics Debts

Managing cross-border logistics debts can be a complex task for businesses. We encounter various challenges that require careful attention and strategic planning. One of the key challenges is dealing with third-party logistics providers. These providers play a crucial role in the supply chain, but their involvement can also introduce additional complexities and potential risks.

Legal Considerations for Cross-Border Logistics Debts

When it comes to managing cross-border logistics debts, there are several legal considerations that businesses need to keep in mind. Compliance with international trade laws and regulations is crucial to avoid any legal complications. It is important to understand the jurisdiction and enforcement procedures of the countries involved in the cross-border transactions. Additionally, businesses should be aware of the contractual obligations and dispute resolution mechanisms that may arise in case of non-payment or delayed payment. These legal considerations play a significant role in ensuring smooth cross-border logistics operations.

Strategies to Minimize Cross-Border Logistics Debts

In order to minimize cross-border logistics debts, we need to implement effective strategies. One important aspect is communication. Maintaining clear and open lines of communication with our partners and customers is crucial. This helps to prevent misunderstandings and resolve any issues that may arise. Another strategy is risk assessment. Conducting thorough risk assessments allows us to identify potential areas of concern and take proactive measures to mitigate them. Additionally, efficient processes play a key role in minimizing debts. Streamlining our operations and optimizing our workflows can help to reduce delays and errors, ultimately minimizing financial losses. Lastly, collaboration is essential. By working closely with our partners and stakeholders, we can find mutually beneficial solutions and address any challenges together.

Effective Debt Recovery in Cross-Border Logistics

Best Practices for Debt Recovery in Cross-Border Logistics

When it comes to debt recovery in cross-border logistics, we understand the challenges that businesses face. It can be a complex process, especially when dealing with international transactions. However, there are strategies that can help minimize the impact of logistics debts and improve the chances of successful recovery.

The Role of Technology in Debt Recovery

In our pursuit of effective debt recovery in cross-border logistics, we recognize the importance of financial planning. It is crucial to have a well-defined strategy in place to manage and minimize cross-border logistics debts. By leveraging technology, we can streamline our financial processes and ensure timely payments. With the right tools and systems, we can track and monitor outstanding debts, automate payment reminders, and improve cash flow. Technology empowers us to make informed decisions and take proactive measures to recover debts efficiently.

Collaborative Approaches for Debt Recovery

In our pursuit of effective debt recovery in cross-border logistics, we understand the importance of collaboration. Working together with our partners and stakeholders is key to resolving outstanding debts and ensuring smooth operations. By fostering strong relationships and open communication, we can address challenges and find mutually beneficial solutions.

Case Studies: Successful Debt Recovery in Cross-Border Logistics

In our research on successful debt recovery in cross-border logistics, we came across several case studies that highlight the challenges and strategies involved. One notable case study involved a logistics company that was able to recover a significant amount of debt by implementing a collaborative approach with their clients. By working closely with their clients and establishing clear communication channels, they were able to resolve disputes and recover outstanding payments efficiently.

Effective debt recovery in cross-border logistics is crucial for businesses operating in the global marketplace. With the increasing complexity of international trade, it is common for companies to face challenges in collecting outstanding debts from customers in different countries. At Debt Collectors International, we specialize in providing debt collection solutions that are tailored to the unique needs of cross-border logistics. Our team of experienced professionals understands the intricacies of international debt recovery and works diligently to recover your outstanding debts efficiently and effectively. Whether you are a small business or a multinational corporation, our comprehensive debt collection services can help you minimize financial losses and improve cash flow. Contact us today to learn more about how our debt collection solutions can simplify the process and help you recover what you are owed.

Frequently Asked Questions

What are cross-border logistics debts?

Cross-border logistics debts refer to the outstanding financial obligations incurred during the transportation of goods or services across international borders.

What is the impact of cross-border logistics debts on businesses?

Cross-border logistics debts can have a significant impact on businesses, including reduced cash flow, increased financial risk, and strained relationships with suppliers and partners.

What are the challenges faced in managing cross-border logistics debts?

Managing cross-border logistics debts can be challenging due to complex international regulations, language barriers, currency fluctuations, and the lack of visibility and control over the entire supply chain.

What are the legal considerations for cross-border logistics debts?

Legal considerations for cross-border logistics debts include understanding international trade laws, contract terms and conditions, dispute resolution mechanisms, and the enforcement of judgments across different jurisdictions.

What are the strategies to minimize cross-border logistics debts?

Strategies to minimize cross-border logistics debts include conducting thorough credit checks on customers, negotiating favorable payment terms, implementing effective risk management practices, using trade finance solutions, and maintaining strong communication with all parties involved.

What are the best practices for debt recovery in cross-border logistics?

Best practices for debt recovery in cross-border logistics include promptly addressing payment issues, maintaining accurate records, engaging in open and transparent communication, utilizing debt collection agencies or legal services when necessary, and exploring alternative dispute resolution methods.